Wizz Air airline shares have collapsed.

Wizz Air has cut its profit forecast for the first Time in six months. The reason - engine problems that led to a 16% drop in the company's shares at the start of trading.

According to the Financial Times, Wizz Air, whose shares are traded on the London Stock Exchange, predicts a net profit in 2025 of 250 to 300 million euros, compared to the previous forecast of 350 to 450 million euros.

In August of last year, Wizz Air also reduced its forecast from 500 million euros to 600 million euros.

The airline's CEO, József Váradi, stated that Wizz Air is operating in challenging conditions due to the grounding of about 20% of its fleet due to a well-documented engine issue.

Pratt & Whitney engine problems have long seriously affected Wizz Air and forced a reduction in the company's growth plans.

Read also

- The General Staff responded to Russia's statement about a breakthrough in Dnipropetrovsk

- Ukrainians warned about a new massive attack from the Russian Federation: Kyiv and 8 other regions at risk

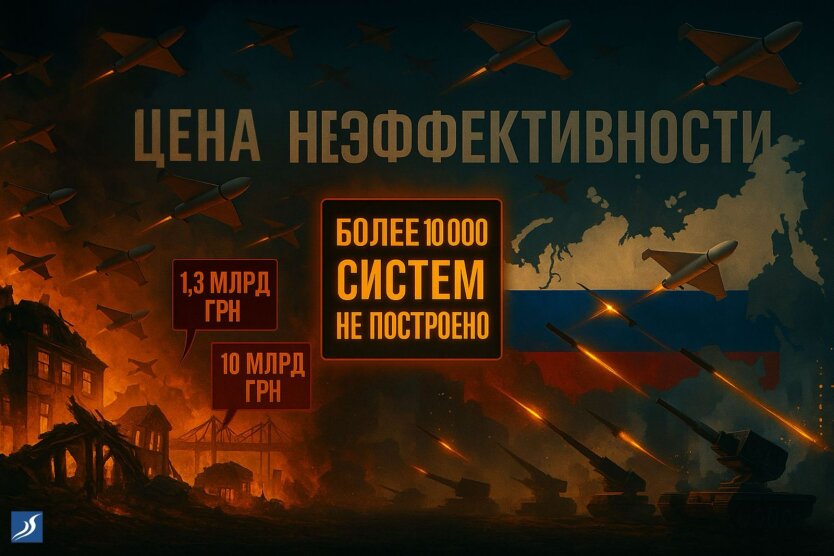

- The Cost of Inefficiency: Large-Scale Russian Attacks Require Large-Scale Organizational Responses from Ukraine

- War may come to us: the head of the Czech Republic issued a troubling warning

- Zelensky: The USA unexpectedly sent missiles intended for Ukraine to another country

- Zelensky said where Trump sent the 20 thousand missiles promised by Biden